Putting in place the right accounting software solutions for any business is imperative to make sure that your business has accurate records for all its statutory obligations, including VAT and Corporation Tax. Finding tools that help you understand and manage business performance and cash flows is key to achieving the highest possible success. Doing all that is the most cost-effective way, having accessible information at your fingertips is of paramount importance to achieving results.

The following guide has information and links on some of the essential tools that will help your business as it grows. The table below links directly to the relevant sections to help you navigate directly to areas of interest. If you have any matters you would like to discuss with us, we are highly skilled accounting systems specialists. Contact us to arrange a time to discuss further with you.

Contents

Introduction

By the time your business reaches 25 or more employees, you are progressing towards the ‘M’ in ‘SME’, and accounting software starts to matter more than ever. Smaller businesses and start-ups often get by with a combination of unwritten processes, spreadsheets, and software subscriptions without an underlying plan – and that’s fine when the business is small. As it grows, however, its administrative and financial burdens also increase – ranging from payroll obligations to taxation and regulatory compliance – alongside the importance of streamlining accounting operations themselves.

Inefficient, ad hoc accounting and data entry practices may make little difference to one of the two-person operations, but can cripple a larger 25+ employee business. In addition, by the time a business reaches this size, it has probably accumulated a wide variety of software systems that integrate more or less badly with each other – further wasting time and dissipating effort.

The solution?

We recommend taking a look at your current accounting and financial admin processes and streamlining to save money and time. In our experience, medium-sized businesses only need four essential accounting tools to operate efficiently and effectively.

This guide will introduce the features and benefits of all four – or, rather, three recommended tools, plus a fourth drawn from a choice of leading platforms. There are, of course, hundreds of finance applications available, and some may be of better use to your industry than others. This guide provides a quick reference resource you can use to guide your investment decisions, but if in doubt, have a chat with an experienced accountant.

To start with, let’s jump into the question of accounting software – probably the most important software investment a business can make, and one that starts to matter a great deal as your enterprise progresses past a certain size.

1) Accounting Software

With the exception of a handful of well-funded start-ups, most businesses with 25+ employees are going to have an accounts package in place. If not, or if your current accounting software isn’t serving you well, then this is the first place to look when investing in software tools, and also the first area to give attention to when upgrading your software.

Locally Installed And Legacy Software

A lot of established businesses still use older versions of accounting software, which while perfectly functional, depend on locally installed software on each device, and rely on a lot of data entry. This means having to manually input every invoice and purchase order, manually reconcile bank statements and accounts payable, and manually make submissions and reports to HMRC. This not only wastes time compared with more automation-rich software but also increases the risk of duplications and errors, especially if the team are all working from home.

Cloud-Based Software

We strongly recommend that all businesses migrate to a cloud-based accounts package that allows remote access when working from home – from any device – and that comes with a wide range of automation, collaboration, and integration features. There are plenty of individual vendors to choose from, but medium-sized businesses are best off going with one of the big three providers; Xero, QuickBooks, or Sage.

Each of these providers brings decades of high-level business experience to their software and are used by thousands of businesses around the world. They each have a reputation for innovation and customer support and are continually working to upgrade and improve their user experience, and the range of features they provide. Learn more by clicking here.

How To Make The Right Choice

All three platforms are excellent, and we recommend each to our clients based on their individual needs. At David Howard, we are Xero Platinum Partners, QuickBooks Platinum ProAdvisors, and Sage Accredited Account Partners, so we haven’t got a preference for one above the other. We also carry significant systems and IT expertise to help integrate accounting software with other data and systems and create powerful time-saving business systems, reports and solutions. QuickBooks is arguably the easiest to use for people without much accounting or financial experience – hence its popularity among sole traders and start-ups. Xero is the most feature-rich of the leading platforms, with lots of advanced native features and dozens of third-party apps to enhance performance and increase integration with other software. With a small investment of time on set-up, it can help automate many recurring tasks, saving time and money ongoing. Sage has the advantage of flexibility, with different accounts solutions for businesses at different stages of growth, and for users with varying levels of technical knowledge. Businesses already familiar with a locally installed version of Sage will find it easy to migrate to one of their cloud-based solutions. All 3 have powerful reporting and we have skills and bespoke software to integrate cloud data into Excel reporting if needed, for bespoke reports.

Speak To Us

If you’re considering investing in new accounting software and would like to discuss your options, we’d be happy to discuss the comparative benefits of Xero, Sage, and QuickBooks, and help you make the right decision for your company.

2) Approval Max

Approval Max is an automated approval system for accounts receivable and accounts payable, designed to interface with Xero or QuickBooks. For Xero users, Approval Max works as an automation app accessed through Xero itself, giving you complete control over compliance, fraud prevention, and error detection in your approval process. With QuickBooks Online, the process is similar, the exception being that the app is configured for use through a web browser or mobile device, and is better suited to sole traders and small businesses.

Approval Max handles the entire approval workflow, from bill and invoice review and approval, to purchase order creation. You can set it up to automatically import your bills from Dext (see below) and transfer approved entries to your accounting software.

The beauty of Approval Max is its flexibility. The app can be customised and configured to businesses of any size and virtually any industry – from tech start-ups to hotels, professional service providers, charities, and e-commerce businesses. With an intuitive interface that works with both Android and iOS devices, and an extensive search and reporting function, Approval Max allows clear audit trails for all accounts payable and receivable processes.

Features At A Glance

- Create and approve purchase orders

- Set up approval automation workflows

- Review and approve bills and invoices

- Match invoices to purchase orders

- Match expenditure against budgeting

- Create intuitive reports in multiple file formats

Why Choose Approval Max?

- A fast and feature-rich mobile app that allows users to review and authorise financial documents from their phones, from any location.

- Directly raise purchase orders through Approval Max and have them imported automatically into Xero or QuickBooks Online

- Easy to use software with a huge online resource base. Users familiar with Xero or QuickBooks will be able to pick up the software straightaway.

- Low flat rate monthly subscription cost of £28.50 (standard version), or £69.50 (premium version)

- Subscription includes unlimited users and devices

- Configured to work directly with Xero and QuickBooks

- Free 30 day trial available

- Managed implementation and training package available for £220

3) Wise

Wise is a fast and cheap browser-based tool for making foreign currency payments to suppliers. You can make one-off payments for any amount and in any currency, and track the progress of your transfer to your customer, without setting up an account. If you make regular purchases to suppliers abroad, you can set up a multicurrency account linked to a Wise debit or credit card, with the capacity to make real-time transfers in 50 currencies, at current exchange rates.

The cost savings are significant and quickly mount up, especially when you have a large team making purchases or logging expenses. You save money because High Street business banks usually provide below-rate currency exchange, combined with (often high) transfer fees or foreign currency purchase surcharges.

The refreshing difference with Wise is its transparency. On the website, you can clearly see the fees and rates provided by leading banks for specific currencies and how Wise compares. It’s not always the absolute cheapest or the fastest for transfers, but most businesses don’t have the luxury of swapping between bank accounts to get the best deal, and the rates they get for transfers are normally left to chance.

Money transfers with Wise usually take less than 24 hours, and transfer fees start from just £3.75 for a standard transfer from a bank account (using a transfer of £1,000 into euros as an example), or £6.73 from a debit or credit card.

Features At A Glance

- Transfer from GBP to foreign currencies, make debit card purchases or withdraw cash in foreign currencies for a fixed transfer fee.

- Receive foreign currency transfers into your multicurrency Wise account at no charge

- Make foreign currency transfers and purchases at the actual exchange rate, with no hidden fees!

- Set up a business account for free

- Schedule bulk payments in multiple currencies

- Connect your Wise account, bank statements, and accounts software through an API that can be used on all devices

Why Choose Wise?

- Regulated by the Financial Conduct Authority (FCA)

- An established service provider with more than 9 million UK customers and a 4.7-star rating on Trustpilot over more than 107,000 reviews (86% of reviewers rated Wise as excellent)

- Discounts are available for high-volume monthly transactions, and for large individual transfers

- Up to 8 times cheaper than UK high street banks

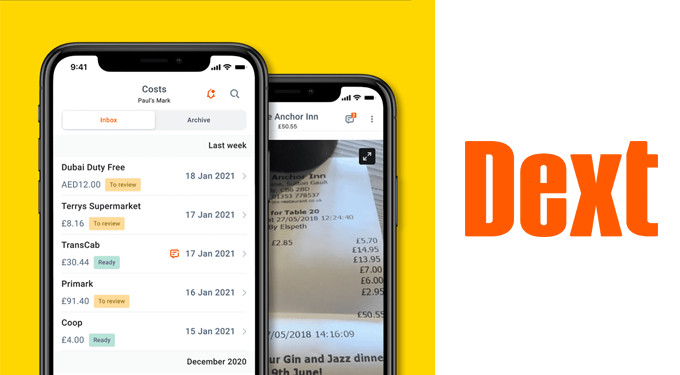

4) Dext

Dext is a handy pre-accounting tool that captures, tracks, and stores all the invoices, receipts, bills, and statements associated with purchases and expenses. When done manually, collating and processing receipts can take hours on an ongoing basis, because it’s one thing converting bank statements to accounting records on Xero, Sage, or QuickBooks, and quite another tracking down online receipts on Uber, Amazon, Spotify, and online service providers – not to mention physical receipts from petrol stations, train tickets, and shops.

As your business grows, the number of business expenditures and expenses balloons. Many of these day-to-day expenses are tax-deductible, and all have to be accounted for carefully in order to provide a clear audit trail. Dext is the only application you need to extract and import important invoice data, without getting lost in a mountain of physical receipts and paperwork.

Invoices, statements, and bills from online purchases can be automatically stored and captured – before being imported into your accounting software. Meanwhile, physical receipts can be captured or scanned through a phone or tablet, which accurately extracts the important data. Bills, invoices, and even bank statements can be uploaded to your cloud-based Dext interface on the go, from any Internet-enabled device.

Using Dext, purchase data can be shared with all relevant team members, without having to log in to half a dozen email accounts and online suppliers to find the information you need.

Features At A Glance

- Just £40 per month for a Premium Plan, which gives you 20 users and allows you to process up to 3,000 invoice and receipt scans each month. (Smaller businesses can use a Business plan for a single user, or Business Plus, for up to 5 users)

- Single-click integration with all leading accounts software packages

- Upload information into R in CSV or spreadsheet format

- Sends submissions to your accounts platform automatically, eliminating paper trails and data entry

- Accurately extracts important invoice and billing information through a straightforward mobile phone scan – more accurate than manual data entry, and much faster

What Makes Dext Great?

- Reduce data entry and remove spreadsheets from your receipt handling process

- Improve accuracy and remove the risk of duplications and human error from data transfer – through an advanced interface that uses a balance of AI machine learning and human input

- 14-day free trial available

- 4.6 star average Trustpilot rating, with 80% of reviewers considering the software to be excellent

Integration & Streamlining

Accounting platforms, Approval Max, Wise, and Dext are powerful platforms in their own right. However, businesses get the full benefit of these essential tools when they are all integrated together. Integration is a term that is often used when discussing software and cloud services, but what does it mean in practice, when it comes to user experience?

- Saves time: Essentially, an integrated software system means not having to open and close multiple apps and spreadsheets in order to accomplish a task. This saves time by physically shortening workflows, both in terms of the number of steps involved, and the time needed to complete a task. When coupled with automation – the means by which a software program completes certain manual tasks (such as submitting Real-time Payment Information to HMRC) without the need for physical input – the time savings can be considerable.

- Reduces errors: Integration also improves efficiency by reducing the number of duplicates and missed entries in your processes. When 25 or more employees potentially have access to a system, the problem of duplicate, inaccurate, or out of date records becomes a real difficulty. Integration avoids this in two ways – first by providing cross visibility between platforms, and secondly, in some cases, by creating auto-updates across all users and systems, whenever one record is updated.

- Improves teamwork: Finally, integration improves transparency among team members working on the same project and increases a sense of team cohesion among colleagues working on different tasks in different departments. This is especially important when using cloud applications and working remotely, as it avoids the sense of detachment that comes from homeworking, and avoids miscommunications and delays from people being unclear about their roles and tasks.

So, when investing in essential business tools, the ability to interface and integrate with other leading third-party apps is critical. The closer these systems can integrate, and the more they can cross-communicate between each other and automate manual tasks, the greater the savings to your business, and the better value your get from your investment. We’ve chosen the tools in this guide specifically because of how well they work together in practice, and how much time, energy, and money we’ve seen them save our customers on a day-to-day basis. They illustrate just some of the possibilities of software that has evolved over the last 5 to 10 years, but there are many different options of off-the-shelf software and bespoke programming which can be tailored to suit needs and budgets. Staff time is costly and relatively small investments can dramatically reduce costs of finance staff and increase the power and accessibility of data and reporting.

About David Howard

David Howard Accountants are a chartered accountancy business based in Surrey, serving businesses throughout London and the Home Counties. We provide a range of flexible, cloud-based accountancy services, and can also advise businesses on how best to integrate their cloud services and software platforms, to reduce red tape and save valuable time. If you’d like to learn more, please give us a call today on +44 20 8977 0905.

Next Steps/Find Out More

Accounting and finance is an important part of business admin but doesn’t exist as a silo, apart from other business processes and operations. The more a business grows, the more accountancy has the potential to guide business decisions, enable intelligent planning, and help lower overheads and increase margins. To get full visibility over your accounting, and the biggest benefit from this intelligent accounting approach, it’s important to use integrated software tools.

At David Howard, we enable businesses to harness the power of cloud services to streamline and optimise their businesses – whatever sector they work in. Cloud solutions are big time-saving tools for SMEs, but often the full value is only realised when working alongside a partner that specialises in these platforms, such as David Howard. To this end, we offer a range of flexible accountancy, financial planning, and support packages to SMEs that fit in with your business model and help you achieve the full potential of your team.

To find out more or to request a free quote, please don’t hesitate to give us a call on +44 20 8977 0905, or email enquiries@davidhoward.co.uk.