National Insurance Increase - New Health and Social Care Levy

The government has announced today (7th September 2021) that it will be increasing National Insurance (NI) rates for employees, to provide funds to aid the social care sector. The new Health and Social Care Levy of 1.25% will be introduced from the start of the new tax year (6th April 2022).

Individuals who are above the State Pension Age and still working will also be required to contribute to the Levy. So will self-employed individuals and employers. The new tax will begin as a 1.25% rise in National Insurance from April 2022, and will be a separate tax on earned income from 2023.

A policy paper has been released, which discusses the timeline for the changes as follows:

“The Levy will be effectively introduced from April 2022, when NICs for working age employees, self-employed and employers will increase by 1.25 per cent and be added to the existing NHS allocation. From April 2023, once HMRC’s systems are updated, the 1.25 per cent Levy will be formally separated out and will also apply to individuals working above State Pension age, and NICs rates will return to their 2021-22 levels."

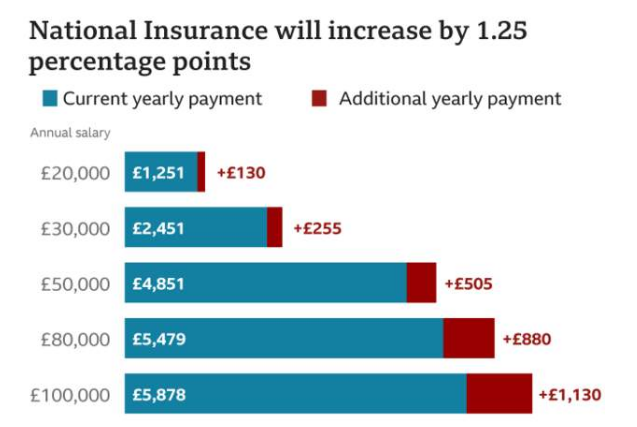

Below is a table released by Gov.uk to show the increase cost to employees.

Once the full details of the scheme has been published by HMRC and the Government we will look at the full cost impact on workers and employers.

Posts by Topic

- Accounting Services (58)

- Tax Services (57)

- Tax (50)

- Smart Accounting Services (34)

- Tax Return (29)

- Corporation Tax (26)

- COVID-19 (24)

- sme accounting (24)

- Clients (19)

- Switching Accountants (16)

- VAT (15)

- Making Tax Digital (13)

- News (13)

- Xero (13)

- Dividend Tax (12)

- bookkeeping (12)

- Payroll (10)

- Cloud Software (9)

- Capital Gains Tax (6)

- Inheritance Tax (3)

- Savings (3)

- Benefits In Kind (Employee Benefits) (2)

- Case Studies (2)

- Stamp Duty (2)

- Trust (2)

- Trust Account (2)

- GDPR (1)

- Insider (1)

- Lifetime ISA (1)

- Retirement Savings (1)

- Wear & Tear Allowance (1)