All businesses and organisations need to maintain accurate and detailed financial records to ensure ...

David Howard Blog

Bookkeeping is an important aspect of running any business or organisation but for medical practices...

A reminder that the extended Corporation Tax Loss carry back measure announced in the Spring Budget ...

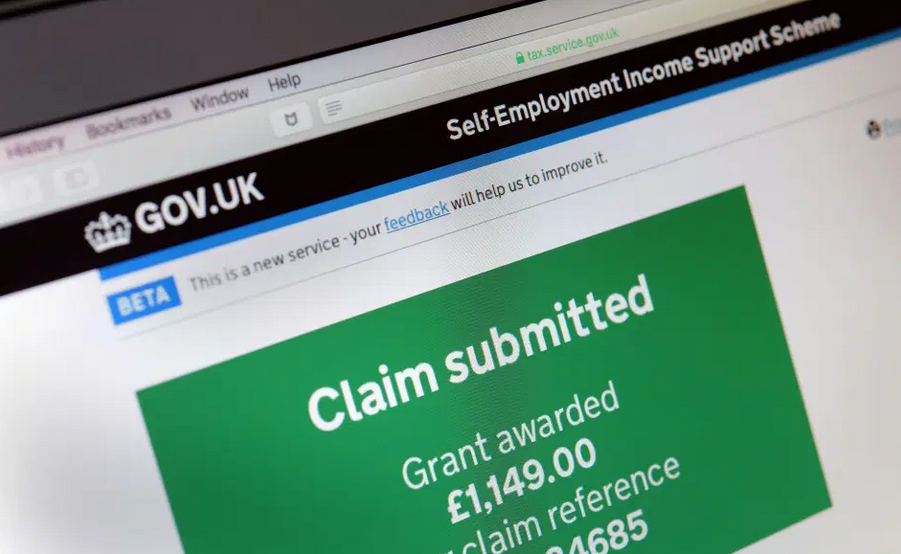

HMRC yesterday issue guidance on claiming the fifth SEISS grant. Full details can be found at the li...

Accounting is perhaps one of the least popular aspects of business ownership (unless accountancy is ...

If you're a buy-to-let landlord, you may still have to pay Capital Gains Tax (CGT) if you make money...

Our new Tax Card has just been published, a very useful reference document to save to your computer ...

Annual Tax on Enveloped Dwellings (ATED) is an often unknown Tax and reporting regime which governs ...

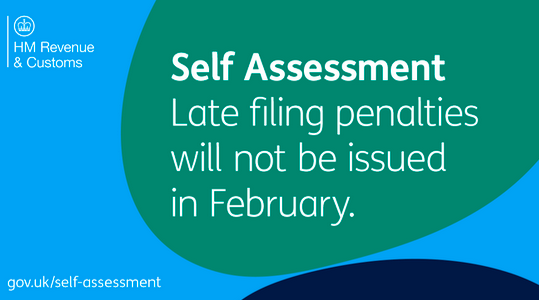

HMRC has announced that Self Assessment customers will not be charged the initial 5% late payment pe...

HMRC have updated their guidance on off payroll working / IR35 regarding the new rules that come in ...