The construction industry has many legislative requirements. Calculating deductions, subcontractor b...

David Howard Blog

The Chancellor Rishi Sunak yesterday outlined additional government support to provide certainty to ...

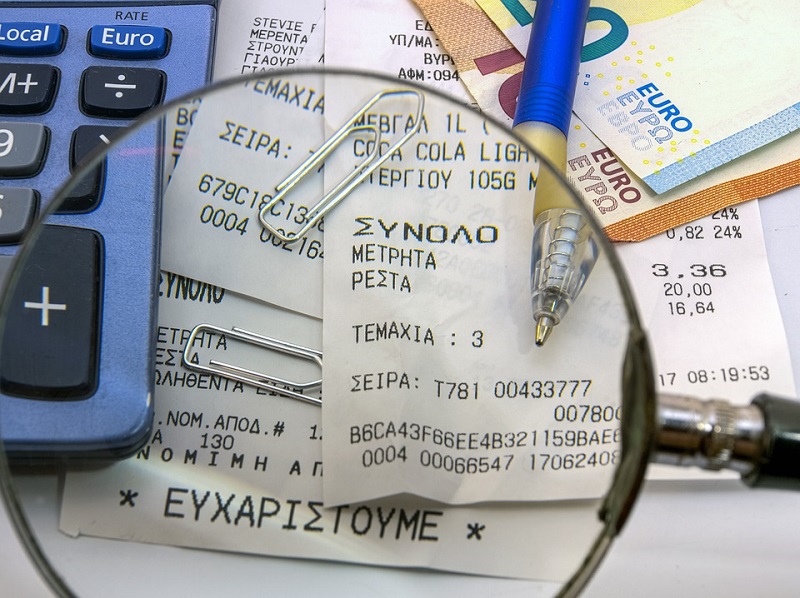

Are you tired of wasting time chasing invoices? Late payments are a well-documented problem for SMEs...

Since its launch in September 2018, the Xero Projects add-on has been one of the most popular financ...

As we approach the end of the deferral period, businesses who did take advantage of the scheme now n...

Yes. All British residential purchase transactions are subject to one form of Stamp Duty, regardless...

Setting up a new business is costly, as the initial expenses required to get up-and-running can quic...

Individual Savings Accounts (ISAs) have been a popular choice for UK savers for over two decades, wi...

Many people believe they wouldn’t fall victim to a financial scam, but the sad truth is that an extr...

Forecasting unlocks the power of accurate strategic planning and enables companies to harness their ...